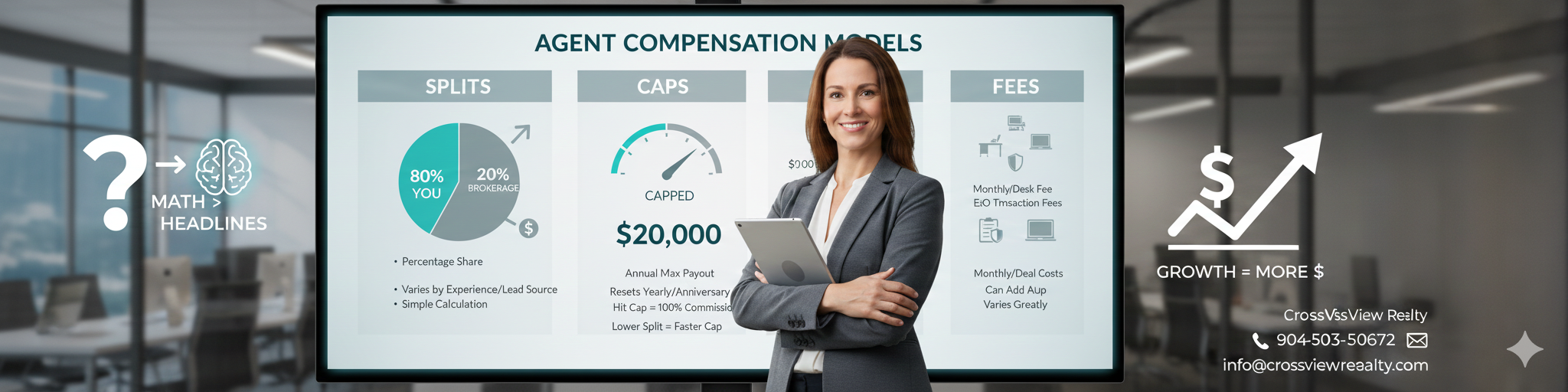

Splits vs. Caps vs. Fees: Which Brokerage Model Benefits Agents the Most?

When you’re comparing brokerages, which compensation model actually benefits agents the most—splits, caps, or fees?

This is one of the most misunderstood topics in real estate. And honestly, it’s where a lot of agents make decisions based on headlines instead of math.

Let’s break this down clearly, one piece at a time.

What a Commission Split Actually Is

A split is simply how your commission is divided between you and the brokerage.

For example:

You earn a $10,000 commission

You’re on an 80/20 split

You keep $8,000

The brokerage keeps $2,000

That’s it.

Splits are straightforward and easy to calculate. When people say “helps me buy, helps me sell,” this is usually what they’re talking about—the portion of the commission you keep versus what the brokerage takes.

Now, splits can vary depending on:

Your experience

Whether the business is self-generated or a lead

Performance milestones

Team vs. independent structures

But at its core, a split is simply the percentage breakdown of each commission.

What a Cap Is (And Why It Exists)

Caps are a newer concept compared to traditional splits. They weren’t common everywhere years ago, but over the last decade they’ve become much more popular.

Here’s how a cap works.

Instead of a brokerage saying:

“We’ll take 20% of your commission forever,”

They say:

“We’ll take 20% until you’ve paid us $X for the year.”

For example:

You’re on an 80/20 split

Your annual cap is $20,000

Each 20% portion goes toward that $20,000

Once you’ve paid in the full $20,000:

You’ve capped

You now earn 100% of your commission for the rest of the cap period

(Minus any additional fees—more on that in a moment)

Important Cap Details to Know

Caps usually reset annually

Some reset in January

Others reset on your anniversary date

You must know which one applies

Why Split Percentage Matters Less Than You Think (When Caps Are Involved)

Here’s something a lot of agents miss.

Let’s say you’re comparing two brokerages:

Same $20,000 cap

Same fees

Same support

Same everything else

Brokerage A: 80/20 split

Brokerage B: 90/10 split

If you’re a producing agent who will cap at both brokerages, you are still paying $20,000 either way.

The difference?

At 80/20, 20% of each deal goes toward your cap

You will cap sooner

That gives you more of the year earning 100%

So if everything else is equal, a lower split can actually benefit high-producing agents because it gets them to the cap faster.

That’s why splits alone don’t tell the full story.

Understanding Fees (The Quiet Cost)

This is where things can get tricky.

Fees can include:

Desk or monthly fees

Transaction fees

Franchise fees

E&O insurance

Technology fees

Printing or marketing fees

Lead fees

Every brokerage structures these differently.

Some brokerages advertise high splits but make up for it with higher monthly or transaction fees. Others roll many services into the split itself.

There is no “right” or “wrong” here—only what makes sense for you.

So… Which Model Benefits Agents the Most?

Here’s the honest answer: it depends on what you need and how you produce.

Agents who need a lot of support, training, and involvement often see:

Higher brokerage splits

Higher caps or no caps

Sometimes higher fees

More self-sufficient agents may prefer:

Lower fees

Faster caps

Less hands-on involvement

But here’s the biggest mistake agents make…

Why Focusing Only on Split Is a Costly Mistake

Agents often chase the highest split they can find.

But here’s what happens all the time:

Agent A pays more to their brokerage

Agent B keeps a higher percentage

At the end of the year, Agent A has more money in their pocket.

Why?

Because the brokerage Agent A paid more to:

Provided better systems

Offered better support

Helped them sell more homes

A smaller slice of a much bigger pie still wins.

Final Takeaway

Splits, caps, and fees all matter—but none of them should be looked at in isolation.

A good brokerage model is one where:

You understand the math

You know what you’re paying

You know what you’re getting

And the structure helps you grow

The best model isn’t the cheapest one.

It’s the one that helps you make the most overall.

Let’s Talk

If you want help comparing brokerage models, breaking down real numbers, or understanding what structure actually makes sense for your business, we’re always happy to help.

CrossView Realty

📞 904-503-0672

📧 info@crossviewrealty.com

No pressure. Just honest conversations and clarity.